July 2024 Market Update

3 More Cities in a Buyer's Market - Incentives Continue to Rise

Rate Drops Equal Major Savings for Buyers

For Buyers:

The second half of 2024 is expected to be better than the first half for buyers in terms of mortgage rates. Last year from July to October rates rose from 7% to 8%, increasing payments by hundred of dollars and knocking many buyers out of the market. This time around, housing analysts are not expecting more dramatic rate increases. Instead, multiple factors are pointing towards improvement.

All eyes are on the Federal Reserve Board to determine when they may drop the Federal Funds Rate this year, but the Fed’s eyes are on annual inflation rates and the labor market. June’s inflation report came down more than expected to 3.0% and the response from mortgage rates was immediate, dropping sharply to 6.82%. That’s a major improvement from the 7.51% recorded on April 30th, and a savings of $187 per month on a $400,000 loan. If rates continue to decline over the summer, then prices may not need to decline to make homes more affordable to buyers.

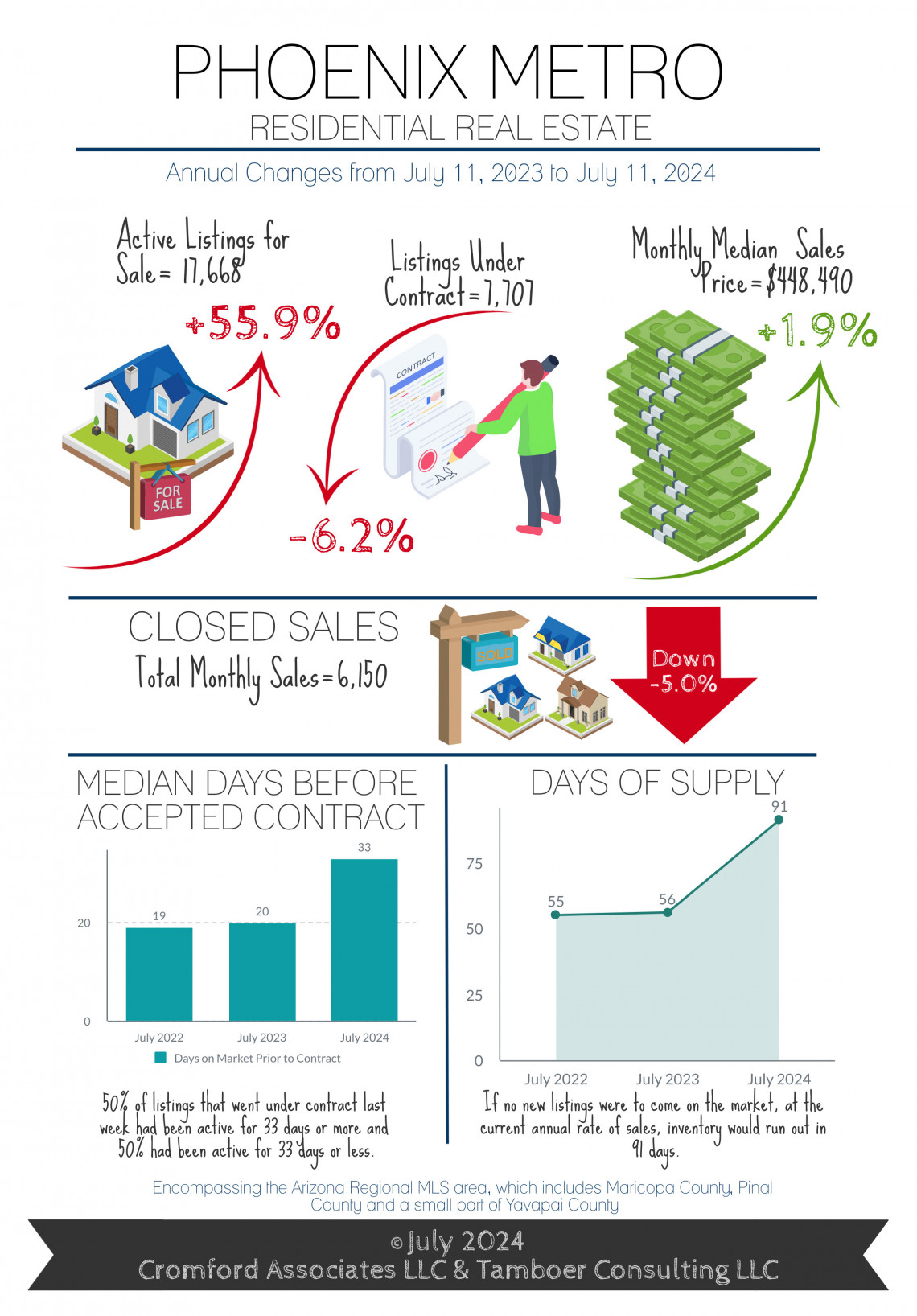

The market continues to get better for buyers. Half of the homes that went under contract in June were on the market for over a month prior to an accepted contract compared to 21 days last year. Price reductions are up 88% over last year, and 51% of sales involved seller-paid incentives to the buyer, the highest percentage this year so far. In June, the median concession paid to the buyer was $9,900, up $500 from May.

As the market has shifted out of a seller’s market and into balance, it has become a friendlier space for not-so-perfect buyers, especially first-time home-buyers. Buyers looking to assume FHA or VA loans with rates under 5%, or purchase with a low down payment, or down payment assistance, will find more opportunities with sellers today. Those same sellers would have scoffed at them 2-3 years ago in preference for cash buyers boasting guaranteed 2-week closing dates and prices that defy appraisals. As with many opportunities in real estate, these conditions will not last forever if mortgage rates continue to decline.

For Sellers:

The Greater Phoenix market has been in a balanced state for two months and the buyers are getting their groove back at the negotiating table. Over the last 30 days, there were two cities that shifted from a seller’s market into balance: Peoria and Paradise Valley. There were 3 cities that shifted from a balanced market into a buyer’s market: Surprise, Goodyear, and Cave Creek. In the meantime, 14 out of the largest 17 cities in the Valley showed a weakening in their market measures in favor of buyers.

There are 9 cities in buyer’s markets in Greater Phoenix as of July, located primarily in the West Valley and Pinal County. These areas have significant levels of new construction. These growing communities increase competing supply as builders create shiny new inventory for buyers to consider. Single family permits are up 56% to-date compared to last year, reflecting a strong optimism here that isn’t reflected in other parts of the country. As the second lowest count of new resale listings hit the market, new construction has little competition and comprises 27% of all single family home sales in the first half of 2024. New builds are formidable competitors for resale sellers.

Meanwhile, sales prices are still holding steady. The median sales price has only increased 1.9% from last year and the average sales price per square foot is up 2.6% annually for the month of June. Its expected that annual price appreciation in a balanced market will stabilize around the rate of inflation. This is a market Greater Phoenix hasn’t seen since 2014-2015. Sellers need to prepare their home for sale, adjust their expectations, market and price their listing, and negotiate buyer concessions. It’s markets like this that demonstrate the need for representation and guidance from a professional real estate agent.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2024 Cromford Associates LLC and Tamboer Consulting LLC

Thinking about selling?

Our custom reports include accurate and up to date market information.

Thinking about buying?

Everyone deserves to love where they live.