November 2024 Market Update

You May Be a First-Time Home Buyer and Not Know It

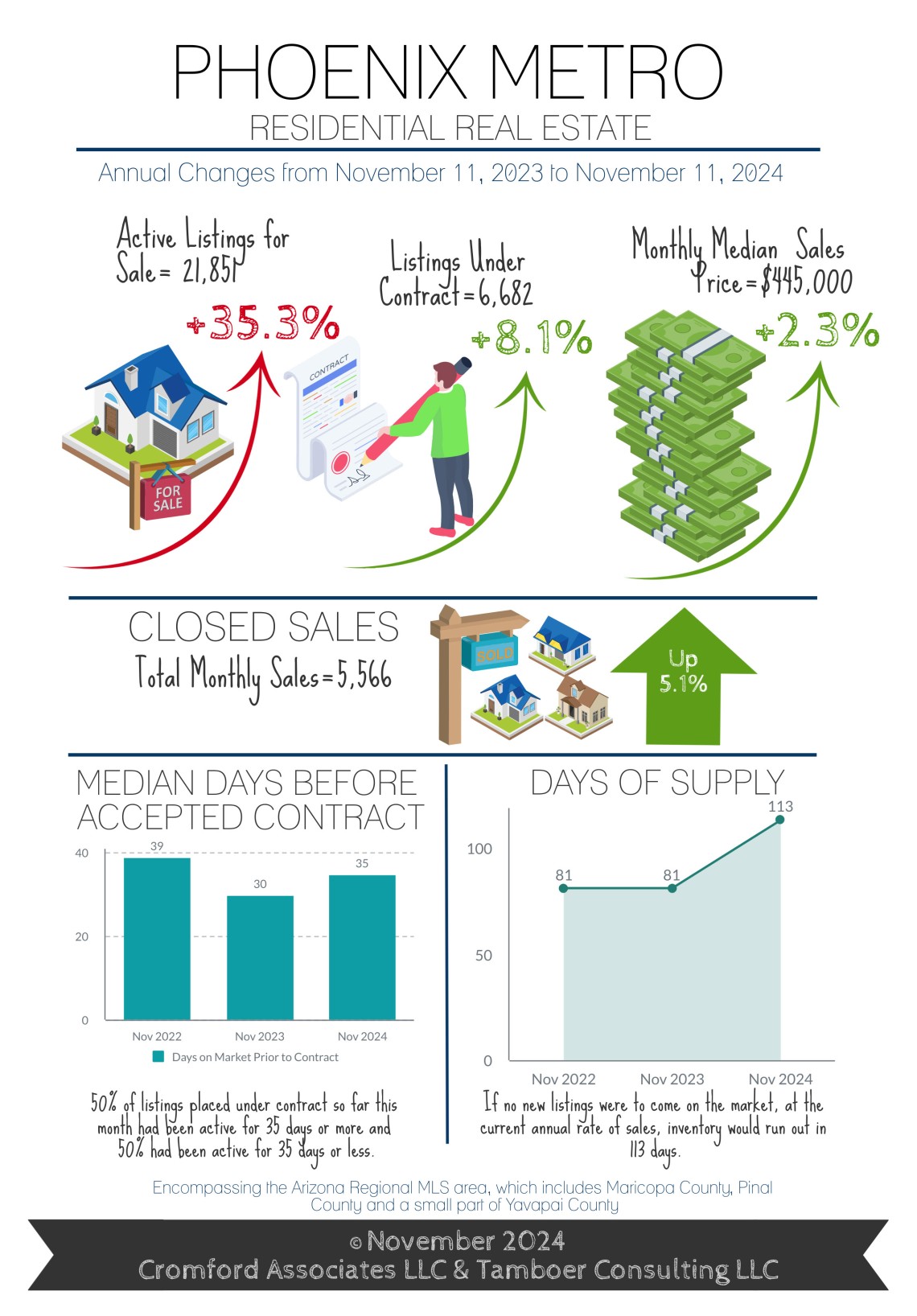

Greater Phoenix is a Buyer's Market Again, For Now

For Buyers:

Newsweek released an article on November 6th announcing that the average age of a first-time home-buyer is now 38 years old, an all-time high (1). One may assume that the increase is due to poor affordability, which is reasonable, but complicating the matter is HUD’s unique definition of a first-time home-buyer.

According to the HUD HOC Reference Guide (2), a first-time home-buyer is an individual who meets any of the following criteria:

- An individual who has had no ownership in a principal residence during the 3-year period ending on the date of purchase of the property. This includes a spouse (if either meets the above test, they are considered first-time home-buyers).

- A single parent who has only owned with a former spouse while married.

- An individual who is a displaced homemaker and has only owned with a spouse.

- An individual who has only owned a principal residence not permanently affixed to a permanent foundation in accordance with applicable regulations.

- An individual who has only owned a property that was not in compliance with state, local or model building codes and which cannot be brought into compliance for less than the cost of constructing a permanent structure.

So even though someone may have purchased their first home with a spouse in their 20’s, had kids, and divorced in their late 30’s, that individual would still qualify as a first-time home-buyer. Or if they sold their home and rented for 3 years, they’re considered a first-time home buyer again. Due to this definition, it’s not surprising that the average age has risen. Why does this matter?

There are specific national, state, and local grant programs that provide closing cost assistance, down payment assistance, and interest rate relief specifically to those who qualify as first-time home-buyers (3). In the past, it was incredibly difficult to convince sellers to accept an offer from a buyer utilizing these aid programs due to the extraordinary competition for homes. However, now the landscape has changed. Greater Phoenix has moved into a buyer’s market now and more sellers are willing to consider accepting offers utilizing these programs in the absence of multiple offers.

Buyer’s markets are rare in Greater Phoenix. While the last one was in 2022, it only lasted 4 weeks. Before that, 2014 fell just short of reaching a buyer’s market, but maintained a slight buyer’s advantage for 4 months. Before that, the last buyer’s market was in 2010, which also lasted 4 months. This time around, it depends on whether mortgage rates stagnate or decline once again. If they drop below 6.5% like they did in September and stabilize, then the market could improve for sellers again within a matter of weeks and the buyer’s market would be over.

For Sellers:

Mortgage rates took an unexpected turn over the past month and popped up from the mid-6% to over 7% once again. As of this writing, they have only slightly dropped to 6.9%. Since rates became excessively volatile in 2022, the housing market has proven time and time again that when they stagnate in the high-6% range or more, it strangles demand. This has pushed Greater Phoenix out of a balanced market and into a buyer’s market over the past 2 weeks. To make things worse, it happened during the 4th quarter, which is typically the lowest time for sellers seasonally.

How long this buyer’s market lasts depends mostly on how long mortgage rates remain elevated. Sellers with less urgency may want to consider listing in the 1st quarter of 2025 as buyer activity picks up from January through May. In the meantime, if they must compete in this marketplace, property condition and competitive pricing at the onset is highly important to ensure a contract. Budget to pick up the buyer’s closing costs, rate buy down, and repairs. Then hunker down for the next 30-60 days as longer marketing times are expected over the holidays.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2024 Cromford Associates LLC and Tamboer Consulting LLC

Thinking about selling?

Our custom reports include accurate and up to date market information.

Thinking about buying?

Everyone deserves to love where they live.