October 2024 Market Update

Federal Reserve Drops their Rate, Buyer Contracts Increase in September

Mixed Emotions for Housing on Positive Jobs Reports

For Buyers:

For the first time all year, listings under contract are higher than they were last year at this time. Over 4 straight weeks in September, average conventional mortgage rates stabilized roughly between 6.1%-6.2%, and 5.6%-5.7% for FHA, which was the sweet spot for buyers to mobilize. Weekly accepted contracts increased 12% during that time frame, confirming expectations that conventional rates need to be sub-6.5% to see a meaningful shift in buyer demand.

Some believe the rates declined as a result of the Federal Reserve reducing the Federal Funds Rate by 0.5pt on September 18th, but mortgage rates had already dropped in anticipation of the Reserve’s actions. It was the follow through of that anticipation that gave consumers the certainty to act and gave the industry hope that relief was on the way.

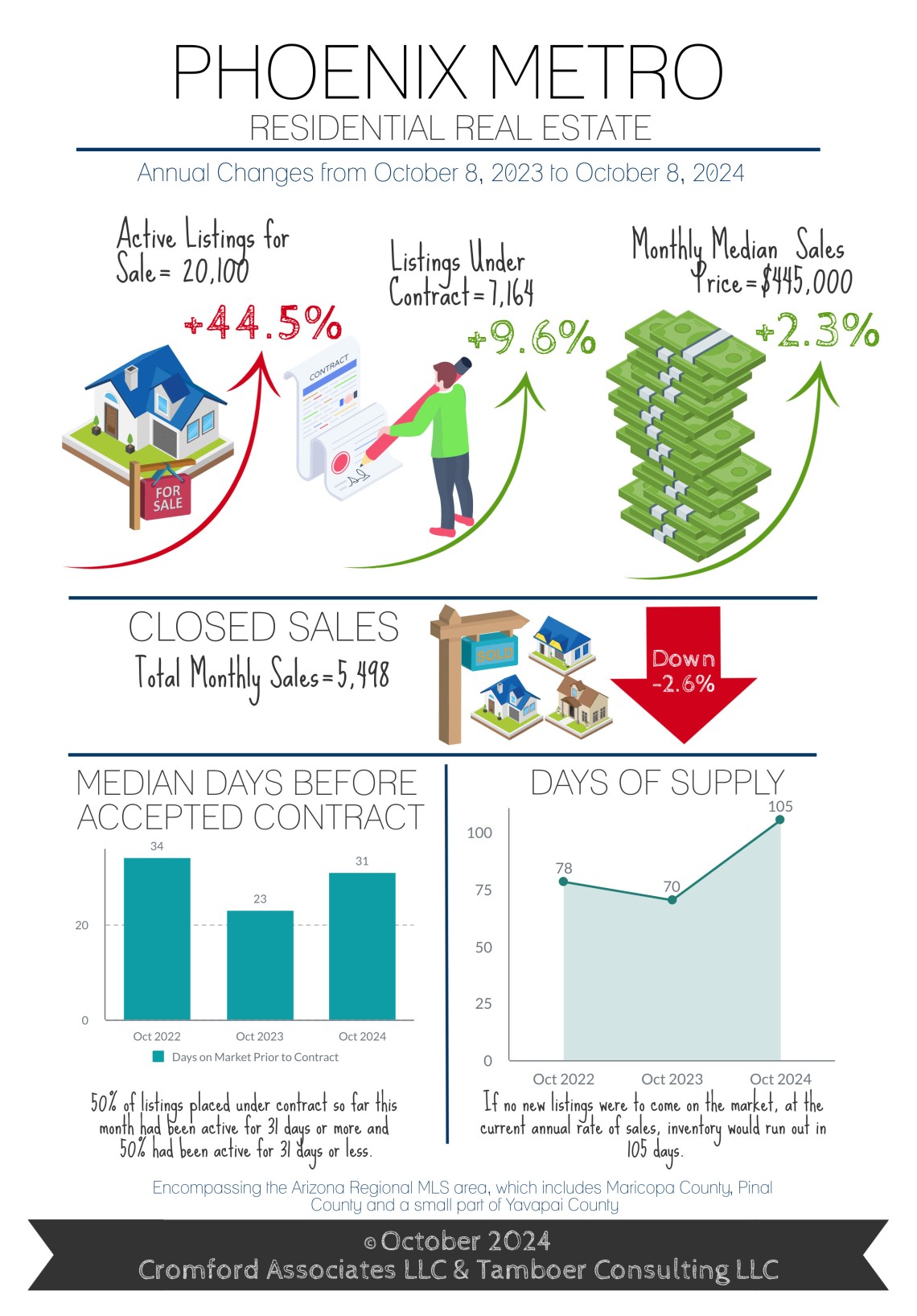

As the 4th quarter begins, the housing environment for buyers is the most favorable its been since December 2022, when there were more than 20,000 active listings in the MLS and a weekly average of 6,148 listings under contract. Back then, mortgage rates had also dropped below 6.5% and hovered between 6.1%-6.5% for 2.5 months. This October, mortgage rates are once again hanging in the mid-to-low 6% range, increasing buyer demand at a time when active listing counts are over 20,000 in the MLS.

Seasonally, this is the best time to be a buyer in Greater Phoenix. It’s typical to see active listings rise as weekly accepted contracts decline, giving existing buyers lots of homes to choose from and fewer competitors. Seasonally adjusted measures, like the Cromford Market Index are showing a market in balance, indicating very little fluctuation in price measures in either direction. In this environment, every drop in the mortgage rate means all properties go on sale.

Greater Phoenix has only seen a market this favorable for buyers twice in the last decade, and both times the opportunity was fleeting; lasting only 9 weeks in 2022 and 5 weeks in 2014.

For Sellers:

While conventional mortgage rates were in the low-6% range for 4 weeks, they popped up to the mid-6% range after the release of a positive employment report citing a decline in the unemployment rate and an increase in wages. The report, while positive, caused disappointment and uncertainty for those anticipating further rate cuts by the Federal Reserve, which indirectly could further improve mortgage rates and housing demand for sellers.

It’s not uncommon for mortgage rates to bounce up a little after significant drops, so it may only be temporary as rates are expected to glide down over the next year. In the meantime, only serious sellers need apply in this market with a slight buyer advantage. With a high count of competing listings for sale, property condition should be a top priority. Gone are the days of simply dropping the price for a less-than-perfect home, or offering a carpet allowance. Small jobs such as replacing carpet, deep-cleaning grout, or brightening up a living room with paint or lighting can make a huge difference in creating a positive first impression on buyers who may not have the funds, the time, nor the desire to do home projects.

Properties listed between $275K-$500K should also budget for incentives to the buyer and longer marketing times over the holidays. More than 62% of sales in this price range close with $8,000-$10,000 in closing cost assistance from sellers that typically contribute to temporary mortgage rate relief. This may be a stretch for those sellers who have only owned their home for 2-3 years as property appreciation has been flat year-over-year since September 2022, providing little equity to accommodate the added expense. Sellers who have owned for at least 3 years or more have more flexibility to provide buyer incentives.

Seasonally, the first half of the year is the best time for sellers in Greater Phoenix as buyer demand rises in the 1st quarter and peaks in the 2nd, tourism is at its peak and marketing times decrease. If mortgage rates decline in 2025 as many lending outlets predict, the Spring season could outperform the last two years as suppressed demand returns.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2024 Cromford Associates LLC and Tamboer Consulting LLC

Thinking about selling?

Our custom reports include accurate and up to date market information.

Thinking about buying?

Everyone deserves to love where they live.